| Peak margin requirement from 01 Sep 2021 will be 100% of the margin required to place orders which must be in client’s account before placing order. As per SEBI Circular this will be the 4th and final phase of peak margin implementation which will be effective from 01 Sep 2021. With the implementation of final phase of peak margin requirement rules by SEBI, there will not be any intraday margin available. Client can place orders ONLY if has minimum VAR + ELM margin required to place such orders. To understand more about margin requirements watch the వీడియో ఆన్ స్టాక్ మార్కెట్ మార్జిన్స్ by clicking the above Youtube Link |

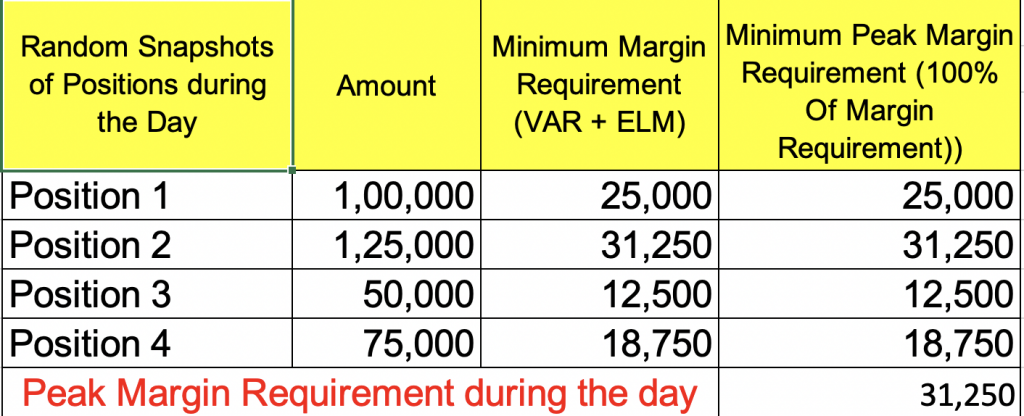

In the above example which shows 100% of VAR+ELM required by a client before placing order in equity market segment. For the purpose of calculating peak margin requirement, highest of the margins during 4 random snapshots will be considered.

From 01 Sep 2021, there will not be no intraday multiplier margins available for trading. All clients need to have 100% of VAR+ELM to place orders. If client do not have sufficient margins, then penalty will be levied which is same as the margin shortfall penalty in derivative segments.

Margin shortfall penalty in equity and derivative segment is as below

< Rs 1 lakh AND< 10% of applicable margin 0.5% Penalty / day

= > Rs 1 lakh OR = >10% of applicable margin 1.0% Penalty / day

If margin shortfall continues for 3 consecutive days in a month, then margin penalty will be 5% per day from 4th day onwards

If margin shortfall is for more than 5 NON-consecutive days, then from 6th day, penalty will be 5% per day for that calendar month

100% Margin requirement does not mean client should have 100% of trade value in account.All clients need to have required VAR+ELM margins as required by stock exchanges. Margins are usually in the range of 12.5% to 100% depending on the volatility and liquidity of the share traded. If a client is placing order with low volatile stocks like ITC etc., required margins will be less. For example if VAR+ELM margin of ITC is 12.5% then if client has 12500 in his account he can still take positions for up to 100000 rupees with out any margin short fall. But if client is trading in stocks like Unitech for which VAR + ELM is 100% then client need 100% of trade value to place the order.